ShmoopTube

Where Monty Python meets your 10th grade teacher.

Search Thousands of Shmoop Videos

Principles of Finance Videos 156 videos

Okay, so you want to be a company financial manager. It's basically up to you to make money for the shareholders. It would also be swell if you mad...

How is a company... born? Can it be performed via C-section? Is there a midwife present? Do its parents get in a fight over what to name it? In thi...

What is an income statement, and why do we need it in our lives? Well, let's take a look at an income statement for Year 1 of the Sauce Company, an...

Principles of Finance: Unit 5, Redeeming Bonds 8 Views

Share It!

Description:

How do you redeem a bond? Can you just do that in the checkout line at Costco?

Transcript

- 00:00

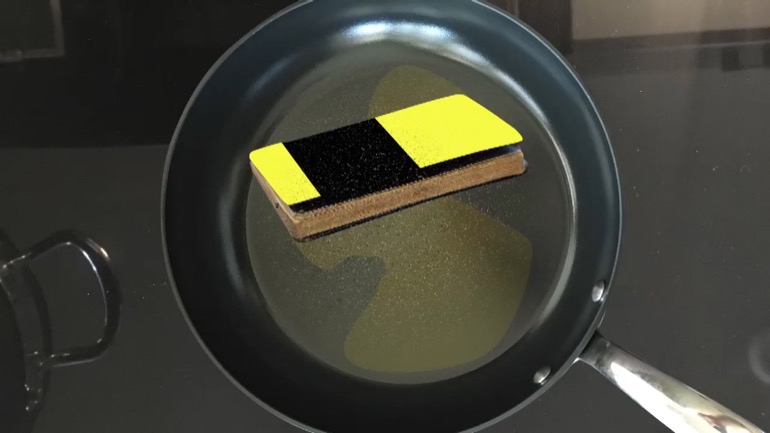

Principles of finance a la shmoop... Redeeming bonds, Robert Downey jr, Paula [Robert Downey Jr and Paula Abdul walking out of rehab]

- 00:09

Abdul, Shawshank Redemption well Redemption is the paying off of a

- 00:14

debt the principle that was originally borrowed you borrowed the money you paid

- 00:18

the interest on it for awhile and then you paid it off you redeemed yourself

- 00:23

from your shameful need of having to borrow money or take on debt that's more

Full Transcript

- 00:29

or less where the term came from anyway we've highlighted the value

- 00:33

of a sinking fund created so that redemption is oh so much easier the idea

- 00:39

is to set things up so that the heavy load of debt on the corporate ship can [Ship carrying debt sailing in the ocean]

- 00:44

be sunk along the way without violent financial shock when the full amount of

- 00:48

the loan is you know suddenly due and corporate CFOs are always on the lookout [Person looking through binoculars at store closing sale]

- 00:53

for a deal it's their job....Joe Bob Billy has a billion dollars par value of nine

- 01:01

percent coupon bonds which were issued in a much tougher credit market than

- 01:05

exists today those bonds now trade for a hundred seventeen cents on the dollar or

- 01:10

a 17 percent premium to par they are callable next quarter at 103 meaning

- 01:16

that there is a three percent premium to call the bonds but the modern you, hello

- 01:21

are told that you can refinance everything for a coupon of about five [Mr Joe Bob Billy's e-mail to refinaince coupon of 5.5%]

- 01:25

and a half percent the savings of three point five percent Interest per year

- 01:30

that's that nine percent minus the five point five percent on that amount of

- 01:34

money is worth the hassle and fees of doing it so you pay the 103 or three

- 01:38

percent premium to call all the bonds ie you buy them back and we'll simply issue

- 01:42

new debt at the lower price and save your company a ton of interest costs

- 01:47

that process is called refunding you funded this company wants with the nine

- 01:52

percent money now you're just doing it again with five and a half percent money [Joe holding 5.5% coupon bond]

- 01:56

and if the markets were really liquid and forgiving well then you that

- 02:00

crackerjack CFO might pre-refund that is before your bonds are even callable

- 02:06

you'd issue new cheap debt so that the money is already in place for you when

- 02:10

your bonds are in fact callable.. rates might have

- 02:13

for a month dipped below 5% and it's worth the fifty basis points spread for [Coins falling]

- 02:18

a few quarters to pay that extra interest just to lock in the ultra cheap

- 02:22

low rate and have no more market risk in going out for loans when it actually

- 02:27

needs to happen like when you actually need the money rather than just want it

Related Videos

GED Social Studies 1.1 Civics and Government

What is bankruptcy? Deadbeats who can't pay their bills declare bankruptcy. Either they borrowed too much money, or the business fell apart. They t...

What's a dividend? At will, the board of directors can pay a dividend on common stock. Usually, that payout is some percentage less than 100 of ear...

How are risk and reward related? Take more risk, expect more reward. A lottery ticket might be worth a billion dollars, but if the odds are one in...